Parliament demands details on expenditure on Agyapa Royalties deal

The Mines and Energy Committee of Parliament has written to the Chief Executive Officer of the Minerals Income Investment Fund (MIIF), demanding details and supporting evidence regarding the government of Ghana's expenditure of $12 million on the botched Agyapa Royalties deal.

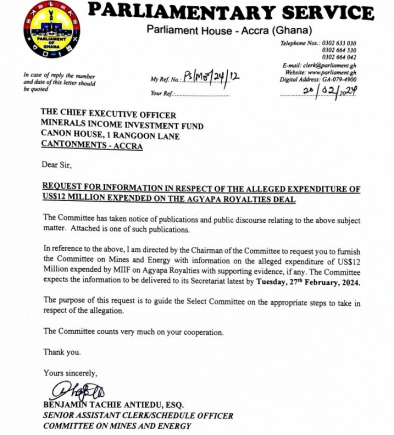

In a letter dated February 20, 2024, the committee chaired by the Member of Parliament for Abuakwa South, Samuel Atta Kyea, stated that it had taken notice of publications and public discourse on the matter and sought guidance on appropriate steps regarding the alleged expenditure.

“In reference to the above, I am directed by the Chairman of the Committee to request you to furnish the Committee on Mines and Energy with information on the alleged expenditure of US$12 Million expended by MIIF on Agyapa Royalties with supporting evidence, if any. The Committee expects the information to be delivered to its Secretariat latest by Tuesday, 27th February 2024.

“The purpose of this request is to guide the Select Committee on the appropriate steps to take in respect of the allegation,” the letter signed by Senior Assistant, Clerk Benjamin Tachie Antiedu said.

The demand by the committee comes on the back of a disclosure by CEO of MIIF, Edward Nana Yaw Koranteng, during an appearance before Parliament's Public Accounts Committee that the government of Ghana spent $12 million on the suspended Agyapa royalties deal.

According to the reports, the amount was spent on the initial offering of the Agyapa Royalties on the London Stock Exchange.

The deal, which aimed to generate funds for crucial infrastructure projects through mineral royalties, was halted by President Nana Akufo-Addo in 2021 following concerns raised by civil society groups and the main opposition National Democratic Congress (NDC).

However, Mr. Koranteng clarified that the amount was spent on the Agyapa Special Purpose Vehicle, payment of consultancy fees, rental of office accommodation, and processes leading to the initial public offering towards the listing of the entity on the London Stock Exchange.

Read the entire letter below;

Leave A Comment