The GH¢742 Billion National Debt: How we got here; what the data shows

The Minister of Finance, Dr. Mohammed Amin Adam, during the presentation of the 2024 Mid-Year Budget Review statement in Parliament, announced that Ghana’s national debt stock stood at GH¢742 billion as of June 2024, which is more than 70% of the country’s Gross Domestic Product (GDP).

This means that Ghana is so indebted that the country would need 70% of the value of all goods and services it produces to settle its debts.

This also means that given Ghana’s population of approximately 31 million, every Ghanaian owes about GH¢24,000.

But how did we get here? Were all the debts accumulated under this current government?

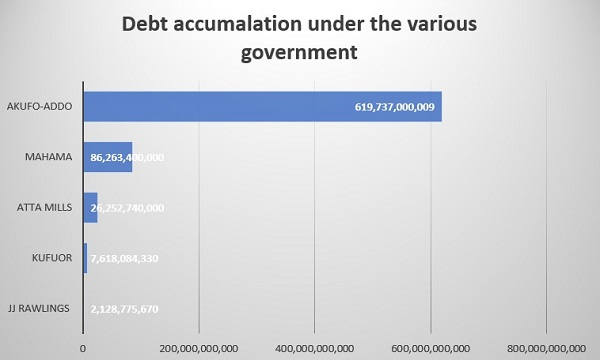

Here is a breakdown of Ghana’s debt

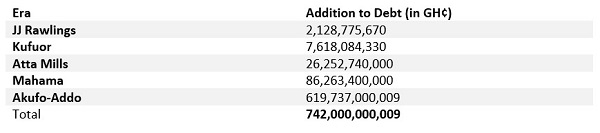

Ghana’s total debt accumulation stood at almost $6.1 billion, which translated to more than GH¢2.1 billion (using the 2008 exchange rate stated in the 2009 budget – ¢3,500.70 per $1) under the first president of the 4th Republic, the late Jerry John Rawlings. These debts included those accumulated in his 8 years of democratic rule (1993 to 2000), his 12 years of military rule, and possibly the country’s debt accumulated before his coup.

Then came the John Agyekum Kufuor government under which the country’s debt rose from the $6.1 billion (GH¢2.1 billion) to more than $8 billion, which translates to more than GH¢9.7 billion using the exchange rate at that time. Ghana’s debt level rose to this height under Kufuor’s regime despite the fact that about 66% of the country’s debt, which translates to almost $6.3 billion, was cancelled through the Highly Indebted Poor Country (HIPC) programme the government entered into, which also came with a lot of grants and other benefits.

Under the late John Evans Atta Mills administration, whose later years were completed by John Dramani Mahama, Ghana’s debt stock rose from GH¢9.7 billion to nearly GH¢36 billion.

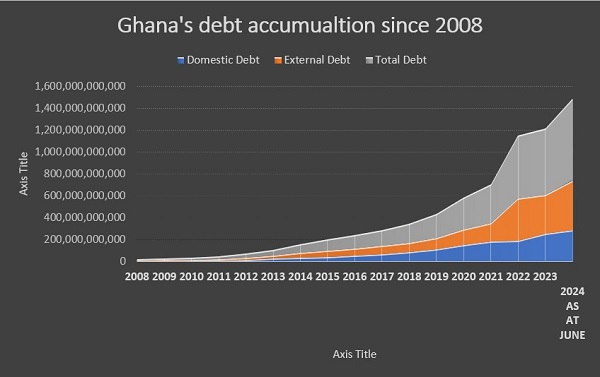

As can be gleaned from the diagram above, the country’s debt started increasing by huge margins after the late Prof. Atta Mills era.

Data from the Ministry of Finance:

Under the John Dramani Mahama administration, Ghana’s debt stock rose from GH¢36 billion to more than GH¢122 billion, meaning more than GH¢86 billion was added to the country’s debt stock under Mahama’s administration.

The debt stock has increased from GH¢122 billion to over GH¢742 billion under the Nana Addo Dankwa Akufo-Addo government, as announced by the current finance minister. This shows that nearly GH¢620 billion has been added to Ghana’s debt stock under the Akufo-Addo government.

Addition to Ghana’s debt stock in the various eras:

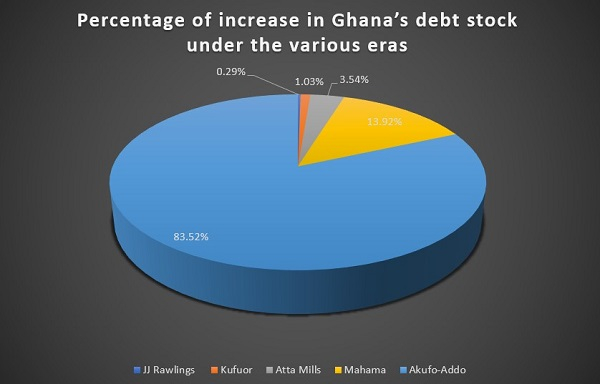

The figures above indicate that more debts have been accumulated under the Akufo-Addo government than any other government, nearly 84 percent of Ghana’s total debt stock. The next government to see more debt accumulation was that of Mahama, with nearly 14% of the country’s debt accumulated under it.

It is instructive to note that the accumulation of debts under the various regimes does not necessarily mean that they borrowed more to reach the debt levels recorded. In other words, the debt stock levels recorded under the regimes are not made up of only new funds borrowed.

Other important factors affect a country’s debt stock, including the depreciation of the country’s currency, which in itself is a function of economic management. This is because the external debts of a country are denominated in foreign currency, and if its currency depreciates, the debt level would go up. So, if the economy is performing badly and a nation’s currency continues to depreciate, its debt level would go up.

The accumulation of arrears for debts incurred by previous regimes also adds to a country’s debt stock.

Also, as economic theory has it that borrowing or accumulating debt is not necessarily a bad thing because public debt can be vital for economic development. It can help countries grow faster by financing productive investment – and the keyword here is ‘productive investment’.

Advanced countries, including the United States of America (USA), all borrow and have huge debt stock. The national debt for the USA, for instance, is more than $32 trillion, and that of Germany is nearly $3 trillion. What matters is the kind of investment this money goes into to propel the needed development for the betterment of the lives of the citizenry.

In addition, borrowing and accumulating debt beyond what a country would be able to service is likely to lead to a debt crisis, which would have serious consequences on the economy and the livelihood of the citizenry.

ghanaweb.com

Leave A Comment