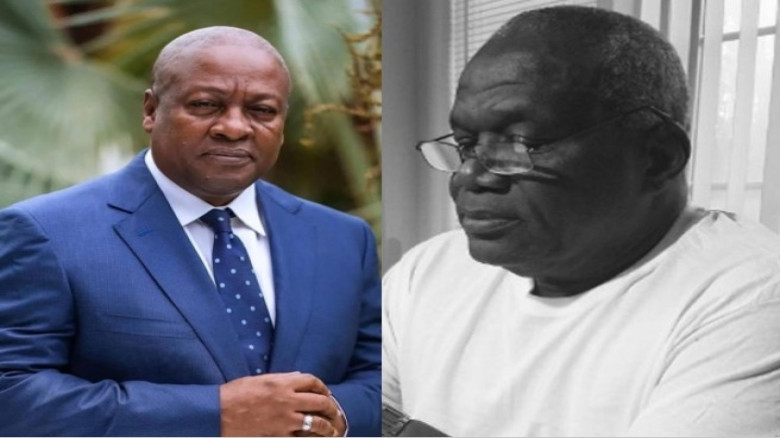

Prez Mahama’s Handling of DDEP Is A Good Sign – World Bank Guru

A retired Economist, Mr. Michael Yaw Offei, has praised President John Dramani Mahama’s swift handling of the country’s Domestic Debt Exchange Programme (DDEP) as very positive.

In an exclusive interview in Tema, Mr. Mike Offei, who has worked with both the World Bank and the International Monetary Fund (IMF) said the report by the President so far is a good signal to the investment community that Ghana is ready for business.

“Just a few months ago, the hair-cut that investors forcibly received over their investment created the impression that the country was broke; such impression is detrimental to any economy since it informs investors that that economy is in no good position to pay back if you lend to it.

It is therefore very heartwarming that the President has taken swift action and has begun paying investors under the DDEP. If I were an investor, this would be the clearest signal to me that Ghana is a place where I can safely invest,” Mr. Michael Yaw Offei said.

The respected Economist who is also a retired diplomat, said this in an exclusive interview on Friday after the 2025 SONA delivered by President John Dramani Mahama.

In it the president announced the government’s successful honour of the matured coupon payment of GHS 6.081 billion (in cash) and GHS 3.46 billion (in kind) due in February 2025 to all Domestic Debt Exchange Programme (DDEP) bondholders.

In addition to this, the president also reported that the government has built additional buffers in the Sinking Fund to honour maturing DDEP bonds due in July and August.

According to Mr. Mike Yaw Offei, “this particular assurance about the sinking fund which is purposed for servicing debt radiates confidence towards the investor community and this is crucial in the capital market.”

Mr. Mike Yaw Offei also praised the Mahama government’s earnest efforts towards completing Ghana’s upcoming fourth review of the IMF-supported Programme review which is scheduled from April 2nd to April 15th, 2025, with the IMF Executive Board expected to approve it in June 2025.

According to him, this is also a good signal to the investor community that Ghana is a country that is poised to find its way out of recent economic difficulties.

“Another highlight of interest to me is the report of a substantial reduction in interest rates for treasury bills with the 91-day treasury bill rate, which was 28.51% on January 6, 2025, decreasing to 24.48% as of February 24, 2025 and the 182-day Treasury bill rate, which was 29.07% as of January 6, 2025, decreasing to 25.388%, while the 364-day Treasury bill rate has also moved from 30.41% to 27.30%.

This means that Ghana’s credit-worthiness is strengthening because usually, high interest on treasury bills means that the issuer’s credit-worthiness is poor and therefore they have to offer higher interest rates in order to attract creditors,” Mr. Mike Yaw Offei said.

Leave A Comment